computation of wacc by prada | wacc equity formula computation of wacc by prada PRDSY (Prada SpA) WACC % as of today (November 02, 2024) is 7.5%. WACC % explanation, calculation, historical data and more. Our Price: $566.74 GA. List Price: 676.51 GA. Manufacturer Lead Time When Not In Stock: 34 days. QTY. Add to Cart. Add Quantity To List. Minimum Order QTY: 4. Item must be ordered in multiples of 4. Click to enlarge. The Loctite 1188048 is a yellow, encapsulating compound that comes in an 1 gal can . It is designed for general potting applications.

0 · wacc slope formula

1 · wacc formula in excel

2 · wacc finance formula

3 · wacc equity formula

4 · wacc debt formula

5 · wacc cost of capital formula

6 · wacc calculation formula

7 · cost of wacc formula

3069 € Pārdevējs: TopNuolaidos Lt. 4.7/5. Citu pārdevēju piedāvājumi (6): 2549 € - 6110 € Daudzums. Cata B-15 Plus T par labu cenu 220.lv interneta veikalā. Ātra un ērta .

perfume l'interdit givenchy valor

wacc slope formula

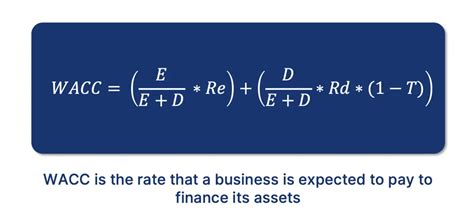

Prada SpA's Weighted Average Cost of Capital (WACC) is calculated as the weighted average of its cost of equity and cost of debt, adjusted for tax. The WACC stands at 6.47%. PRDSY (Prada SpA) WACC % as of today (November 02, 2024) is 7.5%. WACC % explanation, calculation, historical data and more. Notice in the Weighted Average Cost of Capital (WACC) formula above that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, a company with a .

wacc formula in excel

Calculate the weighted average cost of capital (WACC). Describe issues that arise from estimating the cost of equity capital. Describe the use of net debt in calculating WACC.

This weighted average cost of capital calculator, or WACC calculator for short, lets you find out how profitable your company needs to be in order to generate value. With the use of the WACC formula, calculating the cost of . Weighted average cost of capital (WACC) is a company's average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of .

The weighted average cost of capital (WACC) is a financial ratio that calculates a company’s cost of financing and acquiring assets by comparing the debt and equity structure of the business. The WACC is used as a discount rate to determine the present value of future cash flows. Learn how to calculate WACC and how to use it.

The weighted average cost of capital (WACC) is the implied interest rate of all forms of the company's debt and equity financing which is weighted according to the .We see this calculation in the worksheet "WACC." Please note that in this example, we have used a company's actual cost of debt as a proxy for its marginal cost of long-term debt. A company's marginal cost of long-term debt may be better Step # 5 – WACC Calculation. So after calculating everything, let’s take another example of WACC calculation (weighted average cost of capital). In US $ Company A : Company B: Market Value of Equity (E) 300000 : 500000: .Definition: The weighted average cost of capital (WACC) is a financial ratio that calculates a company’s cost of financing and acquiring assets by comparing the debt and equity structure of the business. In other words, it measures the weight of debt and the true cost of borrowing money or raising funds through equity to finance new capital purchases and expansions based on the .

Weighted Average Cost of Capital (WACC): Formula, Analysis, Examples The Weighted Average Cost of Capital (WACC) is a key component in discounted Cash flow valuation (or “DCF” for short). In a nutshell it is the market-value weighted average AFTER-TAX cost of debt and equity of a company. DCF is one the two most fundamental company valuation WACC – Weighted average cost of capital, expressed as a percentage; E – Equity; D– Debt; Ce – Cost of equity; Cd – Cost of debt; and; T – Corporate tax rate. The corporate tax rate takes into account the tax deduction on interest paid. How to calculate WACC?The WACC of Prada SpA (1913.HK) is 7.4%. The Cost of Equity of Prada SpA (1913.HK) is 8.05%. The Cost of Debt of Prada SpA (1913.HK) is 4.25%. . 8.05%: Tax rate: 21.90% - 30.30%: 26.10%: Cost of debt: 4.00% - 4.50%: 4.25%: WACC: 6.0% - 8.8%: 7.4%: WACC. 1913.HK WACC calculation. Category: Low: High: Long-term bond rate: 2.9%: 3.4%: Equity .The exact value of the WACC calculation depends on which of these estimates is used. It is important to remember that the WACC is an estimate that is based on a number of assumptions that financial managers made. For example, using the CAPM requires assumptions be made regarding the values of the risk-free interest rate, the market risk premium .

The components of the WACC calculation, including the risk-free rate, market risk premium, and company-specific risk factors, all have roots in prevailing market conditions. This means that as the economic and investment climate shifts, WACC will naturally adjust, ensuring that it remains a timely and relevant benchmark for decision-making. 3. Sources of Capital All sources of capital, including : common stock preferred stock Bonds any other long-term debt are included in a WACC calculation. A firm’s WACC increases as the beta and rate of return on equity increase, as an increase in WACC denotes a decrease in valuation and an increase in risk. How to calculate WACC (simplified WACC formula calculation) WACC is found by determining the proportions of debt and equity financing that a company uses to determine the total cost of capital. To calculate WACC, finance professionals use the following formula: WACC = (E/V x Re) + (D/V x Rd x (1 – T)) Where: E = market value of the firm’s . Evaluating investment opportunities and assessing business valuation requires quantifying risk and return tradeoffs. We can all agree that an accurate weighted average cost of capital (WACC) estimate is essential for sound financial analysis.. In this post, I will demystify WACC and clearly explain its calculation, real-world applications, and sensitivity to key variables.

What is WACC. WACC stands for the Weighted Average Cost of Capital.. The above term has two major parts to decipher; weighted average and the cost of capital. Weighted average tells that we are going to average out some numbers based on their proportion.. And the cost of capital, in the simplest terms, means the cost you’re bearing for your capital 💰 .

Calculation and Interpretation of Weighted Average Cost of Capital (WACC) 24 Oct 2022. . Example: Calculating the WACC. Assume that company XYZ has the following capital structure: 25% equity, 10% preferred stock, and 65% debt. Its marginal cost of equity is 12%, while its marginal cost of preferred stock is 9%. . WACC Calculation helps to improve Financial Decision-Making. The calculation of the WACC formula follows a systematic approach based on a select number of parameters that either will need to be observed at the market or an estimation required. The WACC is often used in forward-looking analyses such as DCF valuations.

Prada SpA's Weighted Average Cost of Capital (WACC) is calculated as the weighted average of its cost of equity and cost of debt, adjusted for tax. The WACC stands at 6.47%. PRDSY (Prada SpA) WACC % as of today (November 02, 2024) is 7.5%. WACC % explanation, calculation, historical data and more.WACC is used in financial modeling as the discount rate to calculate the net present value of a business. More specifically, WACC is the discount rate used when valuing a business or project using the unlevered free cash flow approach. Notice in the Weighted Average Cost of Capital (WACC) formula above that the cost of debt is adjusted lower to reflect the company’s tax rate. For example, a company with a 10% cost of debt and a 25% tax rate has a cost of debt of .

Calculate the weighted average cost of capital (WACC). Describe issues that arise from estimating the cost of equity capital. Describe the use of net debt in calculating WACC. This weighted average cost of capital calculator, or WACC calculator for short, lets you find out how profitable your company needs to be in order to generate value. With the use of the WACC formula, calculating the cost of capital will be nothing but a piece of cake.

wacc finance formula

Weighted average cost of capital (WACC) is a company's average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. It.

wacc equity formula

The weighted average cost of capital (WACC) is a financial ratio that calculates a company’s cost of financing and acquiring assets by comparing the debt and equity structure of the business. The WACC is used as a discount rate to determine the present value of future cash flows. Learn how to calculate WACC and how to use it.

perfume shop givenchy

photo perfexion givenchy foundation

6 runā par šo

computation of wacc by prada|wacc equity formula